Ways to Pay

Whether it's writing a check, embracing digital platforms, or opting for automatic deductions, there's a payment method tailored to every preference. Select the option that aligns best with your style and take control of your financial management.

Online & Mobile Banking

At home or on the go, login to online banking and head to Money Movement within the navigation menu. You will have the option to make a one-time payment or establish automatic payments.

Login to Get Started

Automatic Payments

Saving time & money by setting up automatic payments from your SFCU savings account or checking account. Setup automatic payments in online banking, contact us at 877-642-7328, chat with us or stop by your local branch.

SFCU Automatic Payments

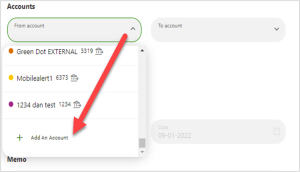

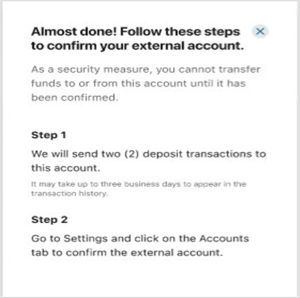

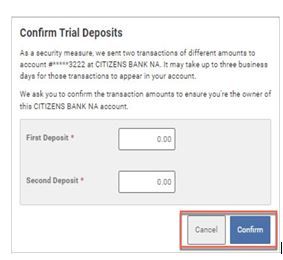

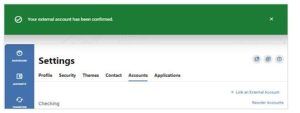

External Funds Transfer

Make a payment from a savings or checking account at another financial institution by logging into online banking selecting Transfers and Add Account. Once you have linked your accounts, you can transfer funds to your SFCU account and pay your loan.

External Funds Transfer

Alacriti

Alacriti is the payment portal that allows SFCU members to make a one-time payment or setup recurring payments from a savings or checking account at another financial institution via ACH (account number and routing number).

Make A Payment

Debit Card

Make a one-time payment* using a non-SFCU debit card. This payment option is only available over the phone with an SFCU contact center agent.

Call Us, Mail or Stop by

Call us at: 877-642-7328

You can make a payment at your local branch or mail it to:

SFCU

42 Union St.

Sidney, NY 13838

Please include your account number and loan ID in the memo line.

-

Any payment(s) received after your 10-day grace period will incur a late fee. You may verify your payment history by viewing your SFCU Account Statement or access your history while logged in Online.

*One-time ACH payments from a non-SFCU account/debit card will incur a $10.00 fee if made over the phone. Avoid fees by setting your payment up online.

Test Modal

Modal Content

Ea rerum vel molestiae omnis molestias. Et ut officiis aliquam earum et cum deleniti. Rerum temporibus ex cumque doloribus voluptatem alias.

Open Account

Leaving Our Website

You are leaving our website and linking to an alternative website not operated by us. We do not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.