Manage your finances anywhere, anytime

Skip the trip to the branch and manage your finances right from your computer or mobile device.

Create and manage goals

Stay on top of your finances by creating and managing savings and spending goals right in online banking.

Credit Score alerts

Enroll to access your Credit Score whenever you are logged in and understand your credit health at any time.

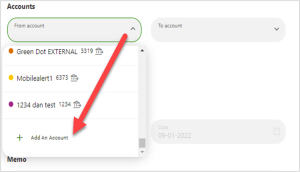

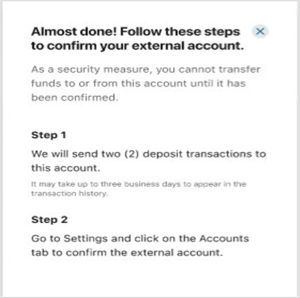

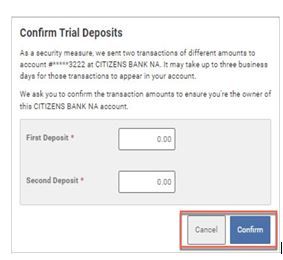

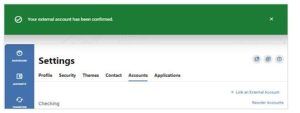

Account transfers

Quick and easy online or mobile transfers made with just a click or tap. Transfer between SFCU accounts or accounts you have at other financial institutions.

View balances

Easily check your account balances and spending. You can even set up alerts to get notices about balances, direct deposits, loan payments, and more.

It's easy to know where you stand

Monitor your credit safely with Credit Score powered by SavvyMoney. With SFCU online banking, you can instantly check your credit score without affecting your report to stay on top of your credit health.

Access from Anywhere

Experience the convenience of account access from your mobile devices.

Chat with a Member Service Representative

Looking for some personal attention? Feel free to contact us and chat with a Member Service Representative. We'll help you set up and manage your SFCU Online Banking account to help you manage finances your way.

Automatic transfers

Never forget to add to your savings account again. Set up automatic transfers from the account of your choice into your savings account to reach your savings goals even faster.

Monitor account balances

With online banking from SFCU, you'll always know where you stand. View account balances to quickly and easily stay on top of your finances.

Every time I go to my local SFCU branch I am greeted and taken care of by well trained employees

-

1

Register

Click "Register for Online Banking" to get started.

-

2

Follow the prompts

Go through the easy setup process. It takes just a few minutes.

-

3

Manage your money

Start managing your money online with your computer or mobile device.

Have a question? Get in touch with us

All the tools you need to simplify financial management

With online banking from SFCU, you can get easy access to all the financial tools you need to manage your accounts right from your mobile device or computer. It has never been easier to manage your money!

Features

Open new accounts

You don’t need to visit a branch to open a new account. Everything can be done through the online banking dashboard for easy & safe financial management.

Apply for loans

Apply securely for loans and make payments on your existing loans anytime, anywhere.

eStatements

Don’t wait for the mail. Get your statements immediately and view them right on your computer or mobile device.

Mastercard Rewards access

Monitor and redeem your Mastercard Platinum Rewards to make the most of your credit card rewards points.

Account alerts

Set up push alerts to be notified of account access, balances, account maturity, loan payment reminders, and more to stay on top of your finances.

View account activity

Quickly and easily see all the tiny details in your accounts by viewing balances and activity to keep track of your spending and budget.

Two-factor authentication

Feel secure with your financial information with two-factor authentication for an added level of protection.

Online bill pay

Pay bills electronically wherever life may take you to simplify payments and avoid late fees.

Test Modal

Modal Content

Ea rerum vel molestiae omnis molestias. Et ut officiis aliquam earum et cum deleniti. Rerum temporibus ex cumque doloribus voluptatem alias.

Let's Get Started!

Not a Member?

We’d love to welcome you to the SFCU family! Getting started is easy – just click the link below to begin opening your account.

Already a Member?

Head over to online or mobile to add a new product. See ‘xPress Accounts’ under ‘Account Services’ Menu. Or select ‘Add a Product’ to get started now.

Leaving Our Website

You are leaving our website and linking to an alternative website not operated by us. We do not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.